General Irrationality and Irreversibility in Economic transactions,

an extension to fundamental economic theory for incorporation of behavioural effects in economic models.

This is an introductory video of the (unfinished) PhD project of ir.Marcel van Berlo (Wednesday, april 12, 2023) Because of a lymphoma interrupting life it is as well my first full lecture of the subject as it will probably my last one.

If you want to contribute or download more files, see the public Github repository for all the information.

This list is a bit a bullet-point script stating the structure and most important subject.

Accompanying video script

1 Intro

Me, my PhD history, motivation, interruption by lymphoma Subject: much economic theory, elegant, mathematical robust, yet no 6-digit prediction precision. Why.

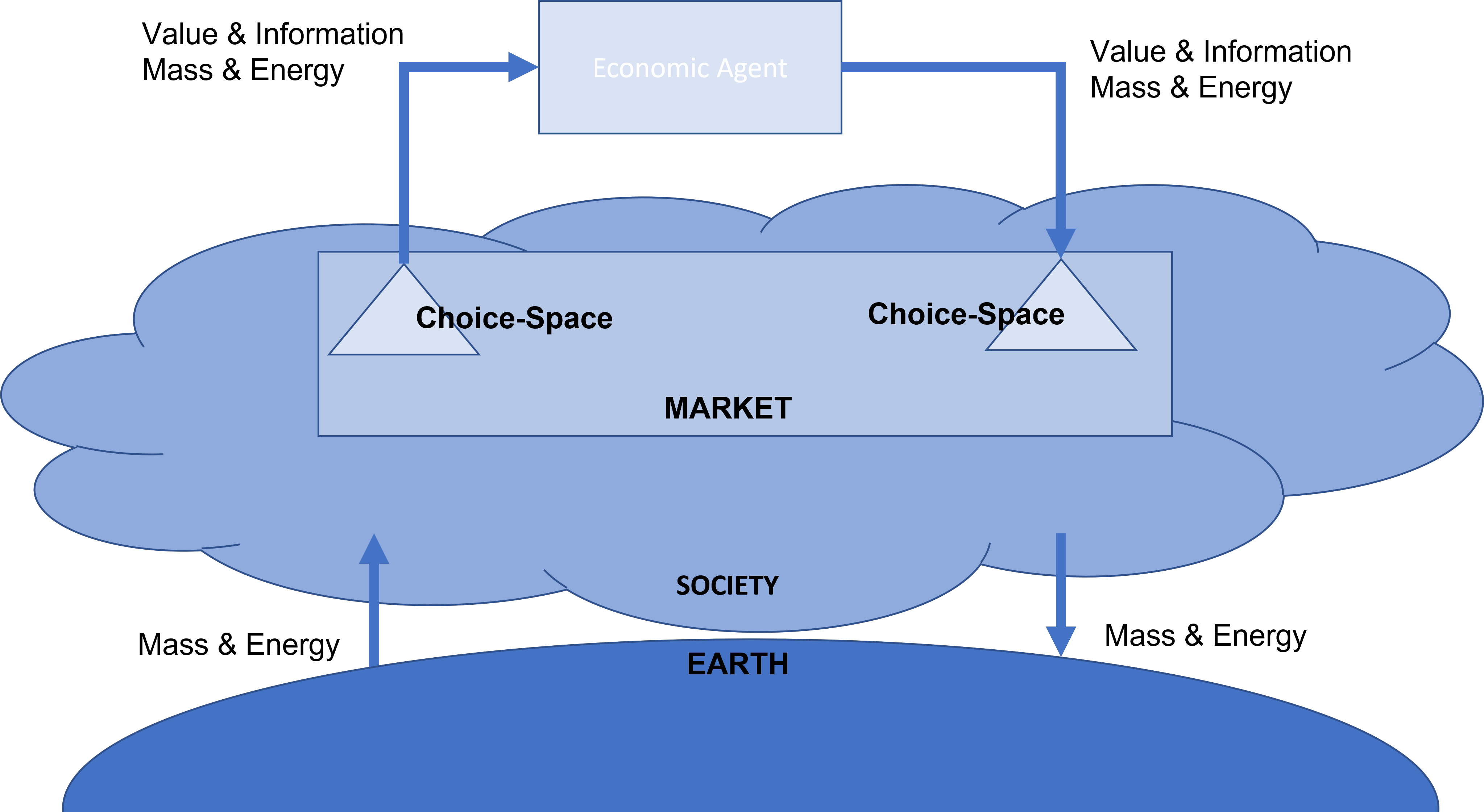

Mathematical modelling is based on assumption of Fully-Informed-Rational-Decisionmaking (FIRD). This allows modelling to converge to (general) equilibria. This asumption is generally justified by the assumption that at aggregate level there is a tendency that the average will follow/learn from the most FIRD economic agent.

Last decades fast growing economic-behavioural literature (eg. Kahneman) has more and more proved that real (economic) behaviour is consistently deviating massively from FIRD modelling.

In this PhD work I develop a set of formal definitions that allow to measure the distance between FIRD and real behaviour in mathematical consistent way. This allows for comparing different behavioural conditions. And it allows for extending economic models with a Degree-of-Irrationality (DIR) to express how far real behaviour deviates from FIRD.

2. Basics: entropy and Choice-Space

Wire options to be straight or in knots Ice-cream choice space binary, evaluation ex-post Ice-cream second CS binary Extensions and nesting of CSs.

Dimensions Size and complexity determinr options to evaluate, mostly a FIRD evaluation is impossible even ex-post if much more info is available.

3. A close-to-FIRD market: stock market

Difference between Income-rationality and Spending rationality. Evaluation much simpler if a buy and sell action are seen within one choice-space. In and output is one-dimensional money-value. However, it requires a 2-dimensional choice-space. In Excel a demo model is made of this with proper formulastruture.

Show some cases. Extension to two or more stocks or more transactions.

4. DIR, value of information

FIRD, is indirectly available ex-post with ol the listing of all stockprices. This is, however, different from reasons for the trends. So it is a substitute-FIRD.

5. DIR and distance to equilibrium

General equilibria are calculated generally with FIRD assumptions in underlying mechanisms. Even if non-FIRD is assumed it is often assumed that an efficient market will tend to migrate close to the efficient FIRD equilibrium. Behavioural economy shows massive distance.

Draw graph with (general) equilibrium and shifter by DIR equilibrium. We know there is this shift, but have no clue about the distance in different conditions, groups, markets, cultures. The DIR is probably more steerable then the FIRD part of the economy. The marketeer power is an industry in itself that is overtaking.all productive sectors like energy, car or foodprduction. And dominating them !

6. S-DIR graph

Properties of the choice-space.

7. Flow of utility /wealth

Always home high to low DIR. Smart people can handle more info more efficient (conscious and unconscious)

8. Accumulation of wealth

Wealth flows in average always from high to low DIR. ! People who are getting rich tend to lose sharpness on real value and utility. Poor people have to be smart and wise to use their money for optimisation of their utility. Poor people are very good in observing the stupidity of rich people.

9. Properties of choice-makers

Graph wealth-DIR. Similar to hearstorage Temp-heat rellation. See formula deduction at end of word file.

10. Conclusions

Production of goods and service for real welfare/Utility has become only part of total production. A (growing) part of production is used for needs that are in many aspects non-contributing to welfare/utility. This does not match with the basic assumption of utility optimising rational agents which has been more or less been the standard thesis sinterklaas Adam Smith. The anti-thesis has been lingering around just about as long; man is often beharing very irrational. This has been mitigated by additional assumptions on market efficiency that creates an aggregate tendency towards a rational option.

This unfinished PhD work creates synthesis between classical economic modelling and the quickly growing knowledge in the behavioural economics. A mathematical framework is defined in which the beauty of good economic modelling can be combined with extensions that allow to incorporate data from behavioural economics.

Due to a fast attacking lymphoma (as of 13-04-2023) I will not be able to finish my PhD. I have confidence that the original thoughts are strong enough for people picking up the ideas. I strongly encourage this, as long as my name & references are always clearly mentioned.

Please work together to create a coherent naming and language use.

Greetings, Marcel van Berlo